How Much Is Property Tax In British Columbia . property tax rates are the rate used to determine how much property tax you pay, based on the assessed value of your. your property tax notice is a bill for some services that are available. Your property is currently assessed at $540,000, based upon a valuation date of july 1 last year. to calculate your property taxes, multiply the taxable assessed value of your property by the property tax rate for your property. Land, home, etc.) located in b.c. The amount you pay depends on the: Find out how to pay your taxes and learn. vancouver property tax rates are the 6th lowest property tax rates in bc for municipalities with a population greater than 10k. Your previous assessed value was. When you own, lease or gain an interest in a property (e.g. every year property taxes are paid by owners and lessees for properties and manufactured home in b.c.

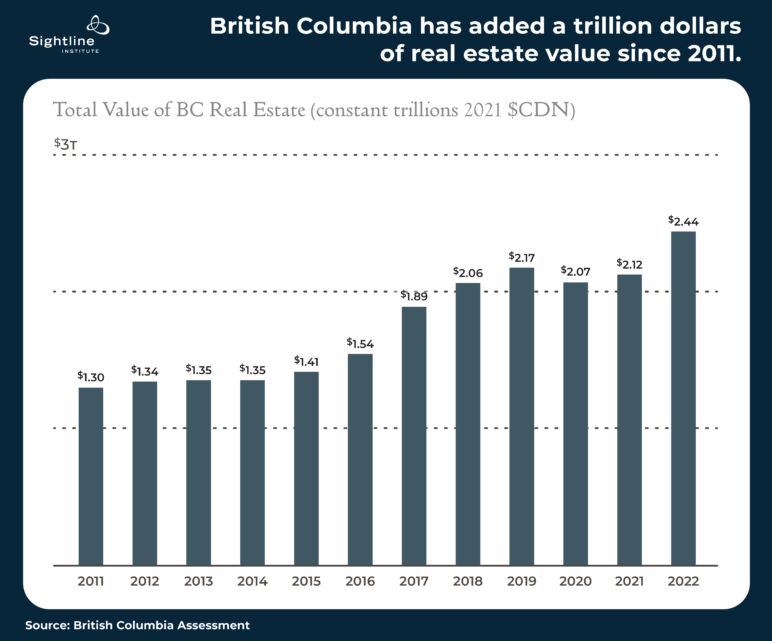

from www.sightline.org

property tax rates are the rate used to determine how much property tax you pay, based on the assessed value of your. Find out how to pay your taxes and learn. When you own, lease or gain an interest in a property (e.g. your property tax notice is a bill for some services that are available. to calculate your property taxes, multiply the taxable assessed value of your property by the property tax rate for your property. Land, home, etc.) located in b.c. Your property is currently assessed at $540,000, based upon a valuation date of july 1 last year. Your previous assessed value was. every year property taxes are paid by owners and lessees for properties and manufactured home in b.c. vancouver property tax rates are the 6th lowest property tax rates in bc for municipalities with a population greater than 10k.

How Low Taxes Lead to High Home Prices in Vancouver, BC Sightline

How Much Is Property Tax In British Columbia When you own, lease or gain an interest in a property (e.g. vancouver property tax rates are the 6th lowest property tax rates in bc for municipalities with a population greater than 10k. Your previous assessed value was. Your property is currently assessed at $540,000, based upon a valuation date of july 1 last year. to calculate your property taxes, multiply the taxable assessed value of your property by the property tax rate for your property. every year property taxes are paid by owners and lessees for properties and manufactured home in b.c. your property tax notice is a bill for some services that are available. Land, home, etc.) located in b.c. The amount you pay depends on the: Find out how to pay your taxes and learn. property tax rates are the rate used to determine how much property tax you pay, based on the assessed value of your. When you own, lease or gain an interest in a property (e.g.

From www.thestreet.com

These States Have the Highest Property Tax Rates TheStreet How Much Is Property Tax In British Columbia property tax rates are the rate used to determine how much property tax you pay, based on the assessed value of your. Land, home, etc.) located in b.c. every year property taxes are paid by owners and lessees for properties and manufactured home in b.c. When you own, lease or gain an interest in a property (e.g. Find. How Much Is Property Tax In British Columbia.

From canadianmortgageapp.com

Land Transfer Tax British Columbia Canadian Mortgage App How Much Is Property Tax In British Columbia every year property taxes are paid by owners and lessees for properties and manufactured home in b.c. When you own, lease or gain an interest in a property (e.g. Your previous assessed value was. Find out how to pay your taxes and learn. vancouver property tax rates are the 6th lowest property tax rates in bc for municipalities. How Much Is Property Tax In British Columbia.

From bc-ca.icalculator.com

2402.908k Salary After Tax in British Columbia CA Tax 2024 How Much Is Property Tax In British Columbia Find out how to pay your taxes and learn. Your previous assessed value was. vancouver property tax rates are the 6th lowest property tax rates in bc for municipalities with a population greater than 10k. your property tax notice is a bill for some services that are available. to calculate your property taxes, multiply the taxable assessed. How Much Is Property Tax In British Columbia.

From www.pinterest.com

This graphic shows the amount of tax charged in each province of Canada How Much Is Property Tax In British Columbia Your previous assessed value was. Land, home, etc.) located in b.c. Find out how to pay your taxes and learn. Your property is currently assessed at $540,000, based upon a valuation date of july 1 last year. vancouver property tax rates are the 6th lowest property tax rates in bc for municipalities with a population greater than 10k. . How Much Is Property Tax In British Columbia.

From taxfoundation.org

State & Local Property Tax Collections per Capita Tax Foundation How Much Is Property Tax In British Columbia Your property is currently assessed at $540,000, based upon a valuation date of july 1 last year. your property tax notice is a bill for some services that are available. to calculate your property taxes, multiply the taxable assessed value of your property by the property tax rate for your property. property tax rates are the rate. How Much Is Property Tax In British Columbia.

From www2.gov.bc.ca

Overdue rural property taxes Province of British Columbia How Much Is Property Tax In British Columbia Your property is currently assessed at $540,000, based upon a valuation date of july 1 last year. The amount you pay depends on the: your property tax notice is a bill for some services that are available. Land, home, etc.) located in b.c. Your previous assessed value was. When you own, lease or gain an interest in a property. How Much Is Property Tax In British Columbia.

From marketbusinessnews.com

Property transfer tax on foreigners could trigger trade war British How Much Is Property Tax In British Columbia Land, home, etc.) located in b.c. vancouver property tax rates are the 6th lowest property tax rates in bc for municipalities with a population greater than 10k. Your previous assessed value was. your property tax notice is a bill for some services that are available. property tax rates are the rate used to determine how much property. How Much Is Property Tax In British Columbia.

From www.pinterest.com

B.C. cities have Canada's lowest property tax rates (INFOGRAPHIC) Tax How Much Is Property Tax In British Columbia property tax rates are the rate used to determine how much property tax you pay, based on the assessed value of your. When you own, lease or gain an interest in a property (e.g. to calculate your property taxes, multiply the taxable assessed value of your property by the property tax rate for your property. The amount you. How Much Is Property Tax In British Columbia.

From web.facebook.com

How to complete your BC speculation and vacancy tax declaration If How Much Is Property Tax In British Columbia property tax rates are the rate used to determine how much property tax you pay, based on the assessed value of your. When you own, lease or gain an interest in a property (e.g. Your previous assessed value was. to calculate your property taxes, multiply the taxable assessed value of your property by the property tax rate for. How Much Is Property Tax In British Columbia.

From www.careerbeacon.com

50,114 a year after taxes in British Columbia in 2023 How Much Is Property Tax In British Columbia vancouver property tax rates are the 6th lowest property tax rates in bc for municipalities with a population greater than 10k. to calculate your property taxes, multiply the taxable assessed value of your property by the property tax rate for your property. The amount you pay depends on the: property tax rates are the rate used to. How Much Is Property Tax In British Columbia.

From www.ey.com

Canada British Columbia issues budget 202021 EY Global How Much Is Property Tax In British Columbia When you own, lease or gain an interest in a property (e.g. The amount you pay depends on the: Your property is currently assessed at $540,000, based upon a valuation date of july 1 last year. vancouver property tax rates are the 6th lowest property tax rates in bc for municipalities with a population greater than 10k. Land, home,. How Much Is Property Tax In British Columbia.

From livingcost.org

Cost of Living in British Columbia 22 cities compared How Much Is Property Tax In British Columbia Your previous assessed value was. property tax rates are the rate used to determine how much property tax you pay, based on the assessed value of your. vancouver property tax rates are the 6th lowest property tax rates in bc for municipalities with a population greater than 10k. Land, home, etc.) located in b.c. to calculate your. How Much Is Property Tax In British Columbia.

From www.todocanada.ca

British Columbia to Provide Property Tax Bill Reduction For Businesses How Much Is Property Tax In British Columbia your property tax notice is a bill for some services that are available. Find out how to pay your taxes and learn. every year property taxes are paid by owners and lessees for properties and manufactured home in b.c. The amount you pay depends on the: When you own, lease or gain an interest in a property (e.g.. How Much Is Property Tax In British Columbia.

From taxfoundation.org

Sales Taxes Per Capita How Much Does Your State Collect? How Much Is Property Tax In British Columbia every year property taxes are paid by owners and lessees for properties and manufactured home in b.c. property tax rates are the rate used to determine how much property tax you pay, based on the assessed value of your. vancouver property tax rates are the 6th lowest property tax rates in bc for municipalities with a population. How Much Is Property Tax In British Columbia.

From tularecounty.ca.gov

Property Tax Revenue Allocation Property Tax How Much Is Property Tax In British Columbia Your property is currently assessed at $540,000, based upon a valuation date of july 1 last year. Find out how to pay your taxes and learn. to calculate your property taxes, multiply the taxable assessed value of your property by the property tax rate for your property. When you own, lease or gain an interest in a property (e.g.. How Much Is Property Tax In British Columbia.

From www.belvideretownshipassessor.com

Property Tax Breakdown_Pie Chart to the Belvidere Township How Much Is Property Tax In British Columbia When you own, lease or gain an interest in a property (e.g. Your property is currently assessed at $540,000, based upon a valuation date of july 1 last year. every year property taxes are paid by owners and lessees for properties and manufactured home in b.c. property tax rates are the rate used to determine how much property. How Much Is Property Tax In British Columbia.

From www.buyhomesincharleston.com

How Property Taxes Can Impact Your Mortgage Payment How Much Is Property Tax In British Columbia Your previous assessed value was. property tax rates are the rate used to determine how much property tax you pay, based on the assessed value of your. every year property taxes are paid by owners and lessees for properties and manufactured home in b.c. When you own, lease or gain an interest in a property (e.g. The amount. How Much Is Property Tax In British Columbia.

From yourequity.ca

Why Pay Property Taxes In British Columbia Canada Call Us How Much Is Property Tax In British Columbia vancouver property tax rates are the 6th lowest property tax rates in bc for municipalities with a population greater than 10k. to calculate your property taxes, multiply the taxable assessed value of your property by the property tax rate for your property. Your previous assessed value was. When you own, lease or gain an interest in a property. How Much Is Property Tax In British Columbia.